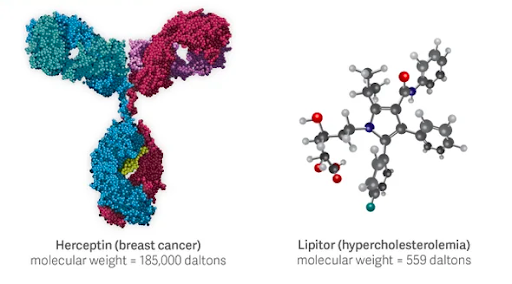

Small molecule drugs and biologics have long been viewed as markedly different therapeutic options, each with unique development pathways, most suitable indications, distinct advantages and disadvantages, etcetera. We are accustomed to the two worlds remaining largely isolated from each other, with companies historically specializing in one area and investment trends shifting in one direction or the other. Certainly, there are distinct differences between small molecule and biologics drugs, as pictured in the image below and broadly summarized in in the table at the bottom of the article.

Source: Scientific American

Research is Becoming Multidisciplinary

Increasingly, these two worlds are blending as companies see that pursuing a broad range of drug modalities may not only be the best investment option, but more importantly, what’s best for patients who need innovative and cost-effective treatment options. As the great divide fades, we are seeing changes in where companies invest, what treatment options look like, and how research & development (R&D) teams collaborate.

1. Companies are Diversifying

From big pharma to manufacturers, many companies are heavily investing to expand their reach into both the small molecule drug and biologics markets—a strategic move considering the portion of new entity approvals attributed to small molecules and biologics has started to equalize in the US.

Some historically-chemistry-focused big pharmas are bringing more biologics programs in-house. For example, Novartis is building a new hundred-million-dollar research center in Switzerland that will help extend its biologics innovation beyond monoclonal antibodies and into antibody-drug conjugates and therapeutic proteins. Amgen spent 26.4 billion dollars in 2022 to expand its biologics offerings with the acquisition of Horizon Therapeutics, a company focused on rare, autoimmune and severe inflammatory conditions.

Manufacturers, such as Lonza, WuXI STA and Catalent, are working to expand their manufacturing capabilities for biologics, including messenger RNA (mRNA) and oligonucleotides. Particularly noteworthy is Samsung Biologics' continued efforts to exponentially increase its global biologics manufacturing capability with the creation of the world’s largest capacity biologics manufacturing plants. But investment in small molecule drug manufacturing also continues. For example, HAS Healthcare Advanced Synthesis and Cambrex, are investing in facilities to produce small molecule active pharmaceutical ingredients (APIs), including highly potent APIs for cancer. In fact, McKinsey reports that many companies are breaking down the barriers between their modality-based chemistry, manufacturing, and controls (CMC) teams so that groups working on small molecule drugs and biologics can better share knowledge and learn from each other.

These anecdotal reports suggest that many companies see diversification as the best way forward.

2. Modalities are Evolving

Lines are also blurring in terms of treatments themselves.

For example, chemically-modified biologics, like antibody drug conjugates that combine small molecule drugs and biologics, are becoming more common and, in turn, are requiring increased collaboration between research groups who have historically worked in their own realms. This type of multidisciplinary collaboration is also key to overcoming some of the limitations of biologics, such as immunogenicity and degradation, which can be addressed by chemically modifying the biologic structure or by utilizing protective drug-delivery vehicles.

We’re also seeing continued research on the novel application of small molecules for targets that have traditionally fallen into the domain of biologics. For example, researchers are exploring the use of small molecules to:

modulate RNA-based processes and gene expression,

function as targeted, dual-binding protein degraders that facilitate the elimination of problematic proteins instead of just blocking them and

act as molecular glue compounds that interfere with protein-protein interactions and interactomes implicated in hard-to-treat diseases like cancer and neurodegenerative conditions.

For hard-to-treat diseases, we’re increasingly seeing both small molecule and biologic treatment options. For example, the often fatal infant neuromuscular disease spinal muscular atrophy (SMA) can be treated with either Spinraza (nusinersen)—an RNA therapeutic that corrects a splicing error linked to the inhibited production of a protein vital to spinal-cord health—or with Evrysdi (risdiplam), a small molecule drug that increases the production of that same vital protein, though the exact mechanism by which it does so is not fully known. Another example is the diverse disease-modifying treatment options available for rheumatoid arthritis, which include biologics and small-molecule drugs called janus kinase (JAK) inhibitors, both which impact the body’s immune response.

The steadfast delineation between modalities and their therapeutic potential is clearly being challenged.

3. Teams are Collaborating

As the worlds of small molecule drug discovery and biologics R&D blend, multidisciplinary collaboration is more important than ever. Modality-centric teams, who have long worked in isolation, increasingly need to collaborate and share data across departments, partner sites, and physical locations. Unfortunately, most companies’ R&D infrastructures haven’t kept pace with their innovative multimodal research efforts. In fact, many teams are still using separate informatics systems, siloed databases, and specialty tools that can’t easily share data. This creates inefficiencies and stifles collaborative innovation. The solution? An R&D platform that supports both small molecule drug discovery and biologics R&D.

Diverse Therapeutic Discovery on One Platform

If you’re looking for a comprehensive R&D platform to support multidisciplinary drug discovery programs for both small molecule drugs and biologics, look no further. Dotmatics can help you:

Support small molecule drug and biologics R&D on one research platform

Unify biology and chemistry data and use it to guide decision-making

Facilitate cross-discipline research and promote workflow optimization

Simplify infrastructure and reduce total cost of ownership

Unite different departments, sites and partners on one secure research platform

Contact us today to learn more about our offerings, including:

End-to-end R&D data platform with robust scientific data-management capabilities

Personalizable ELNs to support small molecule drug and biologics discovery workflows

Entity registration for both small molecule drugs and biologics

Molecular biology, sequence analysis, proteomics, and compound design tools

Assay data management and inventory and lab-request management

Statistical analysis, visualization, and reporting for all diverse R&D data

Small Molecule Drugs vs Biologics Comparison

Item | Small Molecule Drugs | Biologics |

|---|---|---|

Size | Smaller with lower molecular mass | Larger with higher molecular mass |

Structure | Chemical compounds Simple, definable, stable Consistent across manufacturing processes | Biological structures Complex, heterogenous, degradable Highly impacted by manufacturing processes |

Mechanism of Action (MOA) | Interfere with biochemical reactions (e.g., receptor proteins, ion channels, kinases) Exact MOA sometimes unknown | Impact biologic cellular and genetic processes (e.g., protein-protein interactions, protein production, gene expression) Thorough understanding of MOA necessary |

Disease Target | Acute and chronic conditions (e.g., pain, fever, infection, psychiatric conditions, allergies, cardiovascular health) | Complex and hard-to-treat diseases (e.g., cancer, autoimmune disease, metabolic disease, genetic disorders) |

Examples | Antibiotics, proton-pump inhibitors, beta blockers, calcium channel blockers, opioids, benzodiazepines, selective serotonin reuptake inhibitors, antihistamines, synthetic steroids, kinase inhibitors, etc. | Nucleic acids (e.g., RNA), peptides, enzymes, proteins, antibodies (e.g., monoclonal antibodies), cell therapies (e.g., CAR-T), vaccines, hormones, blood products |

Selectivity | Lower selectivity Off-target binding more likely | Higher specificity Off-target effects unlikely |

Safety | Potential toxicity due to off-target effects Higher likelihood drug-drug interactions (due to ADME processes) | Lower toxicity overall Greater likelihood of immune response (immunogenicity) Less prone to drug-drug interactions (due to ADME profile), though some potential to impact drug-metabolizing enzymes |

Production | Straight forward chemical synthesis Standardizable Processes easier to reproduce and quality control (QC) Replicating exact structure across different manufacturing processes is probable | Requires cell line production and live organisms Variable complex processes Processes harder to reproduce and QC Process greatly impacts structure Difficult to attain exact copies from batch to batch |

Structural Assessment | Highly determinable via traditional analytic methods | Elusive and typically not fully determinable Structural determination and quantification challenging |

Permeability | Higher permeability, easier to reach intracellular targets | Less permeable, more challenging to reach targets |

Administration | Oral administration possible Predictable PK and PD Animal and assay models well established Faster time to peak concentration via blood distribution Shorter half-life | Injection or infusion in a care setting typically needed PK and PD difficult to predict Impacted by size, structure, folding, and surface charge Modifications can improve profile (e.g., amino acid substitution, glycosylation, PEGylation, albumin binding, delivery vehicles, etc.). Animal and assay models less developed Slower time to peak concentration via lymphatic and blood distribution Longer half-life |

Stability | Polarity varies Heat stable Stable | Generally polar Heat sensitive Degradable Modifications (e.g., peptide stapling) can help improve degradation |

Storage | Room temp | Refrigeration |

Exclusivity / Generics | Well-established generic market Easier to replicate due to stable structures and processes Straight-forward requirements for establishing generic equivalence and interchangeable prescription substitution 5-year exclusivity before generic competition for new chemical entities (despite similar development timelines) Generic cost reduction ~80% | Burgeoning biosimilar market More difficult to replicate due to complex processes and structures More complex requirements for establishing biosimilarity and attaining interchangeable prescription substitution 12 years exclusivity before generic competition (despite similar development timelines) Biosimilar cost reduction ~20-30% |

Price | Generally lower cost | Generally higher cost (contributing to its rapid increase in market share) |

References

Kesselring, L. “The Differences Between Small Molecule Drugs and Biological Drugs?” Emory Technology Transfer Blog. February 16, 2021.

Buvailo, A. “Will Biologics Surpass Small Molecules in the Pharmaceutical Race?” February 21, 2022.

Lai, Y. and Zhong, X. “Special Section on Pharmacokinetics and ADME of Biological Therapeutics–Editorial.”Drug Metabolism and Disposition. June 1, 2022, 50 (6) 819-821.

Vargason, A.M., Anselmo, A.C. & Mitragotri, S. “The evolution of commercial drug delivery technologies.”Nat Biomed Eng 5, 951–967 (2021).

Boomershine, W. “Structural Characterization of Biologics using High-Res Mass Spec.” (Accessed March 3, 2023).

“What are the challenges of LC–MS strategies for biologic quantitation? How do you avoid these and what solutions have you used to overcome them?” Bioanalysis Zone. June 2, 2020.

The Generic Drug Approval Process. US Food & Drug Administration. March 17, 2022.

Frequently Asked Questions on Patents and Exclusivity. US Food & Drug Administration. February 5, 2020.

Chen, Y., Monnard, A., da Silva, J. “An inflection point for biosimilars.” McKinesy & Company. June 7, 2021.

Andrews, M. “Biosimilar Drugs Are Cheaper Than Biologics. Are They Similar Enough to Switch?” KHN News. September 23, 2021.

Guidance for Industry: Reference Product Exclusivity for Biological Products. US Food & Drug Administration. August 2012.

Biosimilars: Review and Approval. US Food & Drug Administration. December 13, 2022.

Beall, R.F., Hwang, T.J. & Kesselheim, A.S. “Pre-market development times for biologic versus small-molecule drugs.” Nat Biotechnol 37, 708–711 (2019).

Makurvet, F.D. “Biologics vs. small molecules: Drug costs and patient access.”Medicine in Drug Discovery 9 (2021) 100075.

Research and Development in the Pharmaceutical Industry. US Congressional Budget Office. April 2021.